Accessibility and trust in Fintech

Bangalore

15th Nov 2019 at Facebook

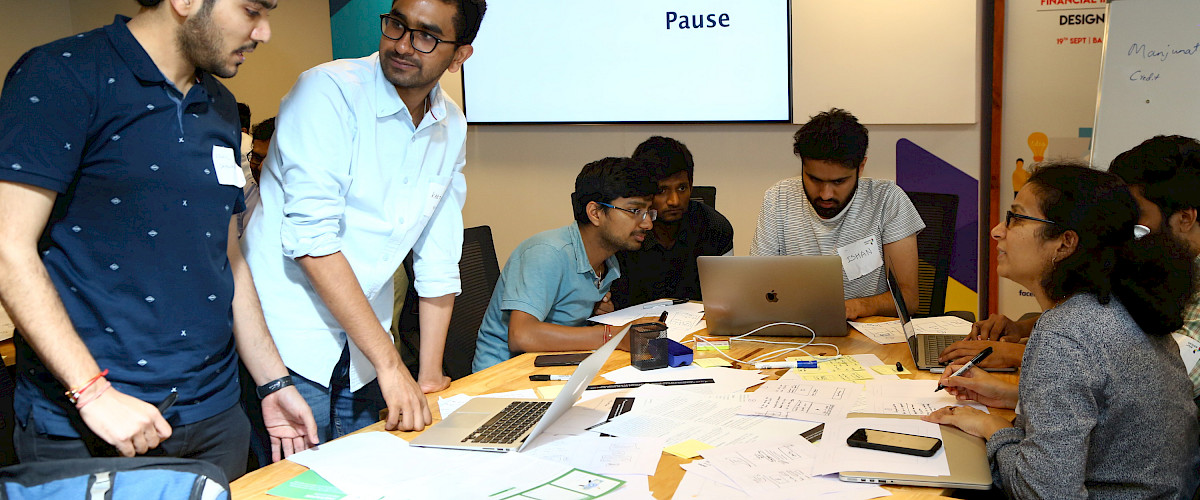

TTC labs has been hosting a series of Design Jams in India under the theme “Design for Bharat” and this was the third design jam in this series.

In this Jam, our goal was to work with Fintech startups in India and help them solve problems in making their products accessible for diverse set of users with various demographics, socio-economic backgrounds and behavioural patterns. We partnered with D91 Labs which is an open source initiative towards financial inclusion in India and has been doing extensive research in this space. Designed by the Labs, the jam was facilitated by our partners at Parallel, a product design and innovation agency in India.

India is going through a data revolution and is set to soon pass a dedicated data privacy law with detailed obligations for companies. As more people come online in India, there is an explosion of the consumer behavior data that is being generated and this is expected to be a $1 trillion opportunity. With such a huge opportunity also comes the responsibility to handle data with care.

Startups in India, especially the ones that are not only building for the urban/metropolitan audience, have the additional challenge of educating before innovating. While innovation is necessary for creating compelling and valuable services we cannot ignore the benefits of educating the user on how their data is being used so that they can make informed choices which further encourages trust between them and the business.

How can we create digital experiences that build trust and make financial services accessible and simpler in an Indian context?

Design innovative yet practical experiences that explain data use and offer control over data collection & usage to bring trust and accessibility in fintech products, thereby contributing to financial inclusion.

People from a variety of disciplines including designers, product managers, researchers, policy & legal experts from Fintech organisations in India like ZestMoney, PhonePe, Scripbox, Razorpay, Cleartax, Flipkart, etc., non-profits like Bill & Melinda Gates Foundation, and think tanks like Takshashila.

Below is an outline of the stages and exercises that took place at this Design Jam. For everything that you need to facilitate your own workshop, please follow the links to the relevant part of our Toolkit.

Since the Jam was focused on Fintech products and we had people attending from different segments of the Indian Fintech ecosystem, we wanted to make sure they find this workshop helpful as well as it leaves them with practical and applicable takeaways for problems they might be facing with their own product.

Discover

On the morning of the Jam, Charu Chadha (Policy Programs Manager for Facebook India) welcomed the participants and introduced Design Jamming.

The participants then took part in discovery exercises around stations:

- Understand People

- [Analyze data transparency in context] - this design jam leveraged research conducted by Bharat Inclusion Initiative to develop personas - find out more about the research here (https://toolkit.ttclabs.net/toolkit/analyse_data-use_notices)

- Design with words.

The exercises were designed to re-frame the audience’s mindset to think in terms of privacy trust & transparency as well as understand the target audience for whom they will be solving the challenge statement later.

Participants heard from subject matter experts Praneeth Bodduluri, Founder at Base Account and Rohan Gupta, CTO of Smallcase.

All participants worked to Identify opportunities by writing How Might We's on Post-Its during these presentations, and these notes were collected by the facilitation team who placed them on the Wall of the day, grouping them into key thematic areas.

Some of the unique groupings of questions that emerged from this Design Jam included ideas on how might we:

- How might we address financial anxiety and design features that tie in with the need of addressing financial anxiety in a country like India?

- How might we educate and address different people and their needs to ensure accurate interpretation and maintain transparency?

- How might we build trust with users who might not be comfortable with online interactions or data sharing?

After the expert session, the participants Split into teams of 8 with a mix of various startups along with experts from the policy side.

The participants were given fictional apps with data use briefs and two personas to choose between. A lot of research went into creating these fictional apps to ensure the apps and the challenge statements are applicable in an Indian context. These are the apps and respective challenge statements we worked on:

- Oink - a money manager app that helps users automatically track monthly spends and categorises them. The challenge was to design an experience that explains to a user why the app needs access to their messages and build trust and confidence through that experience.

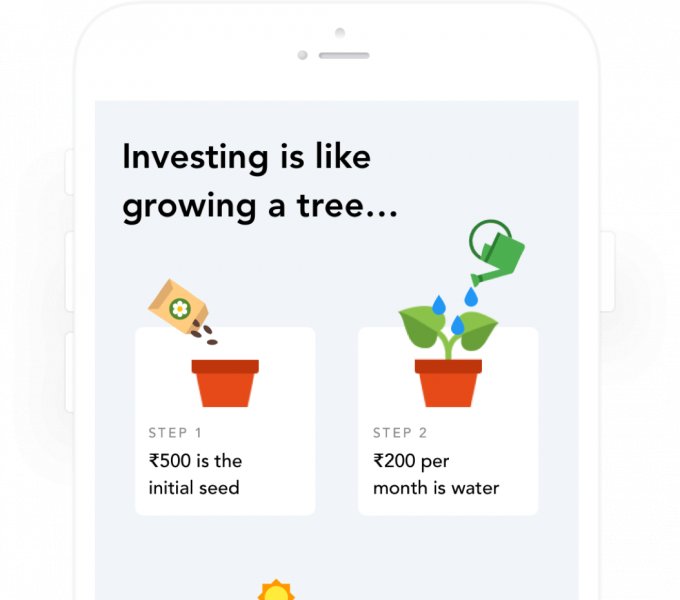

- Money Box - an investing platform that intends to make investing in mutual funds simple and safe. The challenge was to design an experience that helps a novice user build trust by understanding why and how they are being given recommendations so they feel confident about making investments.

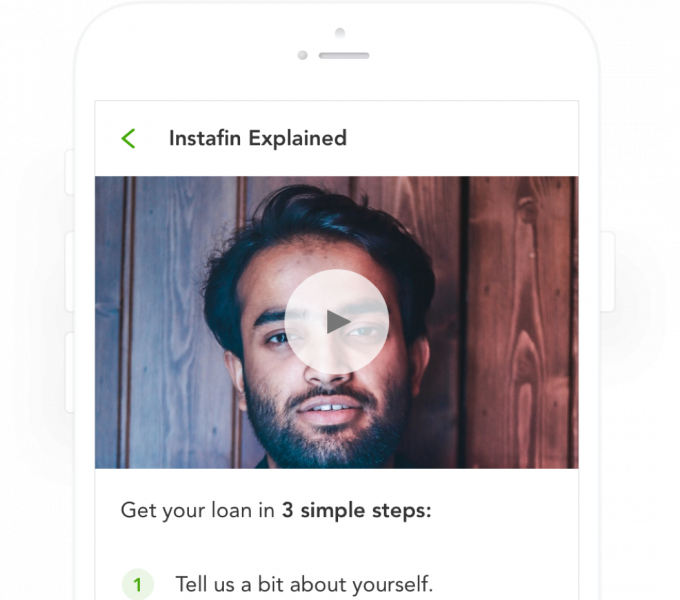

- Instafin - a digital-first lender that provides loans to individuals. The challenge here was to design an experience for Instafin that ensures users feel confident in sharing their sensitive data and provide the service with the data it needs.

- Finwizr - an investing platform that helps users compare, analyse, and invest in mutual funds. The challenge statement; design an innovative trust-building experience for Finwizr, where the product provides context and understanding to its users about fluctuations in value- without misleading them.

The participants then had to refine the challenge and narrow down on a specific problem that they would solve and prototype, coompleting Challenge statements.

The facilitators Set brainstorming rules and introduced the teams to Sketching ideas. Teams moved from sketching ideas and receiving Feedback from other teams to Building digital prototypes of a single idea.

Each team worked on a presentation to Create a pitch, telling the story of their design patterns back to the whole group and receiving Feedback from experts at the end of the day.